Holiday Home in Nunggalan | South Bali

Bali

Listing Id

AVA00089

Project Type

Holiday Home

Project Size

0.03 Acres

Size Range

1184 sq.ft Onwards

Current Status

Under Construction

RERA ID

Not Applicable

Total Units

1

Starting Price

₹1.83 Crores Onwards

About the Project

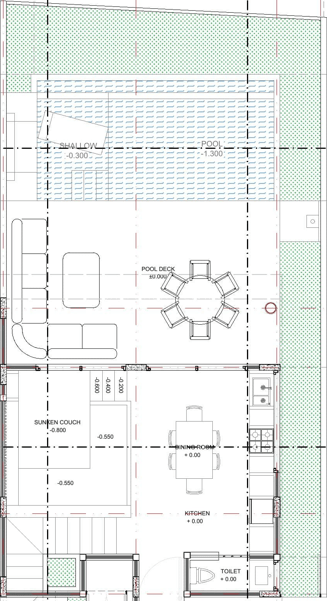

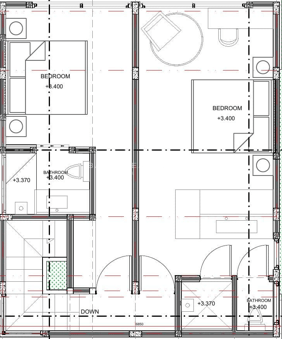

Discover an exclusive retreat in the serene enclave of Nunggalan, South Bali. This contemporary Balinese villa perfectly blends luxury, privacy, and modern design, offering a unique holiday home experience. Targeted at discerning investors and holidaymakers, the property is situated in a prime tourism zone, guaranteeing strong short-term rental demand. The villa features airy interiors, expansive windows for natural light, and a chic sunken living area that brings the lush outdoors in. Its design focuses on sustainability and comfort, complementing the island’s exotic surroundings. As a secure leasehold property, it represents a high-performing asset with significant appreciation potential. The layout is thoughtfully planned for both relaxation and entertainment, with a private terrace and pool. Located minutes from world-class surf spots and iconic Uluwatu landmarks, it offers a refined lifestyle that balances modern comforts with Bali's timeless beauty, promising both a tranquil sanctuary and a smart investment.

Unit Configuration

Amenities

Legal and Financial Information

Ownership | Registeration Cost | Stamp Duty |

|---|---|---|

Leasehold (23 years + extension) | Notary fees typically range from 1% to 2.5% | 5% of the sale value (BPHTB) |

Leasehold | Enquire to know more | 1% of the sale value |

Leasehold (24 Years with extension option) | Approximately 1% of the sale value | 5% of the sale value |

Leasehold (24 years + Extension) | Enquire to know more | Enquire to know more |

Leasehold (39.5 years with extension) | Approx. 1-2% for Notary and legal fees | 5% of the sale value (BPHTB) |

Leasehold (25 years + 25 years extension option) | Enquire for details on notary fees | Enquire for details on local taxes (BPHTB) |

Leasehold (25 Years) | Approx. 1-2% of the sale value | 5% of the sale value (BPHTB) |

Leasehold (25 Years Remaining) | Approximately 1-2% for Notary Fees | 5% (BPHTB - Land and Building Acquisition Duty) |

Leasehold (25 Years Remaining) | Enquire to know more | Enquire to know more |

Leasehold (34 Years Remaining) | Enquire to know more | Enquire to know more |

Leasehold (34 Years Remaining) | Approximately 1-2% of the property value | 5% of the sale value (BPHTB) |

Leasehold (34 Years + 20 Year Extension) | Enquire to know more | Enquire to know more |

Leasehold | 1-2% of the transaction value | 5% of the sale value |

30-Year Leasehold | Approx. 1-2% (Notary Fees) | 5% of the sale value (BPHTB) |

Leasehold (24 years remaining with extension option) | Approximately 1-2% including notary fees | 5% of the sale value (BPHTB) |

Leasehold (26 years remaining) | Enquire to know more | Enquire to know more |

Leasehold (25 years) | Enquire to know more | 5% of the sale value |

Leasehold (26 Years Remaining) | 1-2% including notary fees | 5% of the sale value |

Leasehold (23 years remaining) | As per Indonesian government regulations | As per Indonesian government regulations |

Leasehold (25 Years Remaining) | Approx. 1-2% of the sale value (Notary Fees) | 5% of the sale value (BPHTB) |

Leasehold | 1% - 2% for notary and legal fees | 5% of the sale value (BPHTB) |

Leasehold (30 Years Remaining) | Enquire to know more | Typically 5% of the transaction value |

Leasehold (30 years + extension option) | Approx. 1% for Notary fees | 5% of the sale value (BPHTB) |

Leasehold (24 years remaining) | Approx. 1-2% of the sale value (Notary Fees) | 5% of the sale value (BPHTB) |

Leasehold (29 Years + Extension) | Approx. 1-2% of the sale value (Notary Fees) | 5% of the sale value (BPHTB) |

35-Year Leasehold | 1-2% for notary and legal fees | 5% of the sale value (BPHTB) |

Leasehold (29 Years + Extension) | As per Indonesian regulations | As per Indonesian regulations |

Leasehold (25 years + extension) | 1% - 2% of the sale value (Notary Fees) | 5% of the sale value (BPHTB) |

Leasehold (20 years with guaranteed extension option) | Approx. 1-2% for notary and legal fees | 5% of the sale value (BPHTB) |

Leasehold (24 years remaining with extension option) | Enquire to know more | Enquire to know more |

Leasehold (29 years + 20 years extension) | Approx. 1% for Notary and Legal Fees | 1% (BPHTB - Land and Building Acquisition Duty) |

Leasehold (24 years remaining) | Typically 1-2% including notary fees | 5% of the sale value (BPHTB) |

Leasehold | Approximately 1-2% for notary fees | 5% of the sale value (BPHTB) |

Leasehold (16 years remaining + 20 years extension) | Enquire to know more | Enquire to know more |

Leasehold (25 Years Remaining) | Enquire to know more | Enquire to know more |

Leasehold | 1-2% of the sale value | 5% of the sale value |

Leasehold (20 Years + Extension Option) | Approx. 1-2% of the property value | 5% of the sale value |

Leasehold (30 Years) | As per Indonesian regulations | As per Indonesian regulations |

25-Year Leasehold | Approx. 1% of the sale value (Notary Fees) | 5% of the sale value (BPHTB - Land and Building Title Transfer Tax) |

Property Management

A professional management company will handle all post-possession services, ensuring your investment is well-maintained and profitable. Services include housekeeping, pool and garden maintenance, security, and rental management for a completely hands-off experience. This comprehensive support makes it an ideal investment for absentee owners seeking to generate rental income without the day-to-day hassles of property upkeep.

Financials Returns & Investment Benefits

• High capital appreciation potential in Bali's booming southern tourism hub.

• Strong rental yields from high demand in a prime short-term rental zone.

• Secure leasehold ownership with a 20-year extension option.

• Located minutes from world-class surf breaks, driving premium tourist traffic.

Distance from Social Infrastructure

EDUCATIONAL INSTITUTIONS

• Canggu Community School (30 km)

• Montessori School Bali (25 km)

MALLS

• Samasta Lifestyle Village (15 km)

• Sidewalk Jimbaran (16 km)

MARKET

• Nirmala Ungasan Supermarket (8 km)

• Local fruit markets (2 km)

HOSPITALS

• BIMC Hospital Nusa Dua (18 km)

• Siloam Hospitals Bali (22 km)

Ungasan

Nunggalan is an emerging micromarket in the Uluwatu region, prized for its serene atmosphere and proximity to secluded, stunning beaches. The real estate trend here is dominated by luxury and boutique villas, attracting investors seeking high rental yields from the holiday market. Buyers are typically international lifestyle investors and digital nomads. The market offers competitive pricing compared to more developed areas like Seminyak, with a strong focus on modern-tropical architecture that blends with the natural landscape. Nunggalan provides a tranquil escape while still being a short drive from Uluwatu's vibrant cliff-top bars, restaurants, and surf culture.

Road Connectivity

Jalan Raya Uluwatu Pecatu - 2 km (Approx. 5 mins drive)

Airport

Ngurah Rai International Airport (DPS) - 20 km (Approx. 45 mins drive)

Train Station

Not Applicable

Bus Station

Uluwatu Bus Terminal - 5 km (Approx. 15 mins drive)

Climate Information

• Summer (Mar-Jun): 27-34°C - Hot and humid, perfect for beach and pool activities.

• Monsoon (Jul-Sep): 25-31°C - Cooler with occasional showers, making the landscape lush and green.

• Winter (Nov-Feb): 26-32°C - Pleasant and dry, considered the peak tourist season.

Air Quality Index (approximate AQI as per online sources)

35 (Good)

About:

Bali

South Bali, particularly the Uluwatu peninsula, is one of the fastest-growing real estate markets in Southeast Asia. Its growth is driven by world-class surfing, luxury tourism, and a burgeoning wellness scene. The market primarily consists of leasehold villas and boutique resorts, catering to a high-end international clientele. Demand is fueled by investors seeking strong rental returns and capital appreciation, as well as lifestyle buyers. Price ranges for premium villas are on an upward trajectory, reflecting the area's strategic advantage as a global destination. The development of new beach clubs, luxury hotels, and infrastructure continues to bolster its position as a top-tier investment location.

Real Estate Trends in

Bali

Average leasehold villa prices in Uluwatu have seen a 12-15% year-on-year appreciation.

Short Term Rental Trends

Please find some relevant information below if you are looking to run your property as an airbnb on short term rentals. Please note that this data is an estimate collected from various online and offline resources by Avacasa. The actual performance is dependent upon your specific property, amenities, services, marketing etc. Use the below metrics as a general guide to the market to help in your decision making.

Occupancy Rate

*Occupancy rate represents the percentage of time a property is booked by guests compared to the total time it's available for rent. It's a key metric for understanding how well a market performs.

Average Daily Rate

*Average nightly rate earned for a 2bhk home

Gross Yield

75-85% (Projected annual occupancy for premium villas)

₹18,000 - ₹25,000 (Projected Average Daily Rate)

8-12% (Projected annual rental yield)

*the annual rental income of a property expressed as a percentage of its purchase price, before any expenses like taxes or maintenance are deducted

Nearby Attractions

Few attractions and activities curated by us

Why Invest?

01

A contemporary Balinese design in a secluded, high-demand tourism enclave.

02

Secure investment with a 29-year leasehold and a guaranteed 20-year extension.

03

High ROI potential driven by proximity to world-famous surf spots and beach clubs.

04

Offers an exclusive lifestyle retreat balancing tranquility with vibrant local culture.

Explore More