Luxury Villa in Uluwatu | South Bali

Bali

Listing Id

AVA00137

Project Type

Holiday Home

Project Size

5 Acres

Size Range

1668 sq.ft Onwards

Current Status

Under Construction

RERA ID

Not Applicable

Total Units

25

Starting Price

₹2.15 Crores Onwards

About the Project

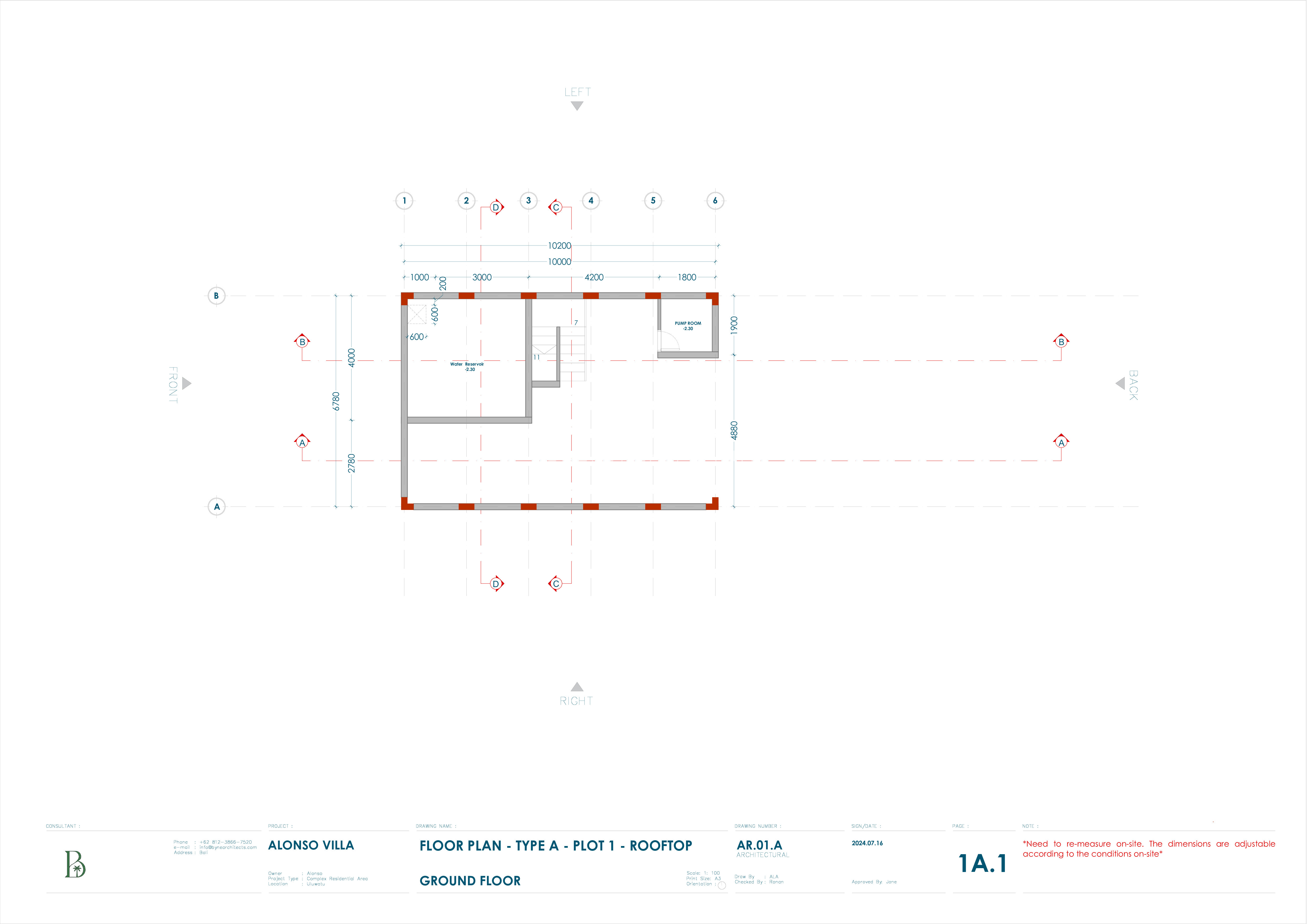

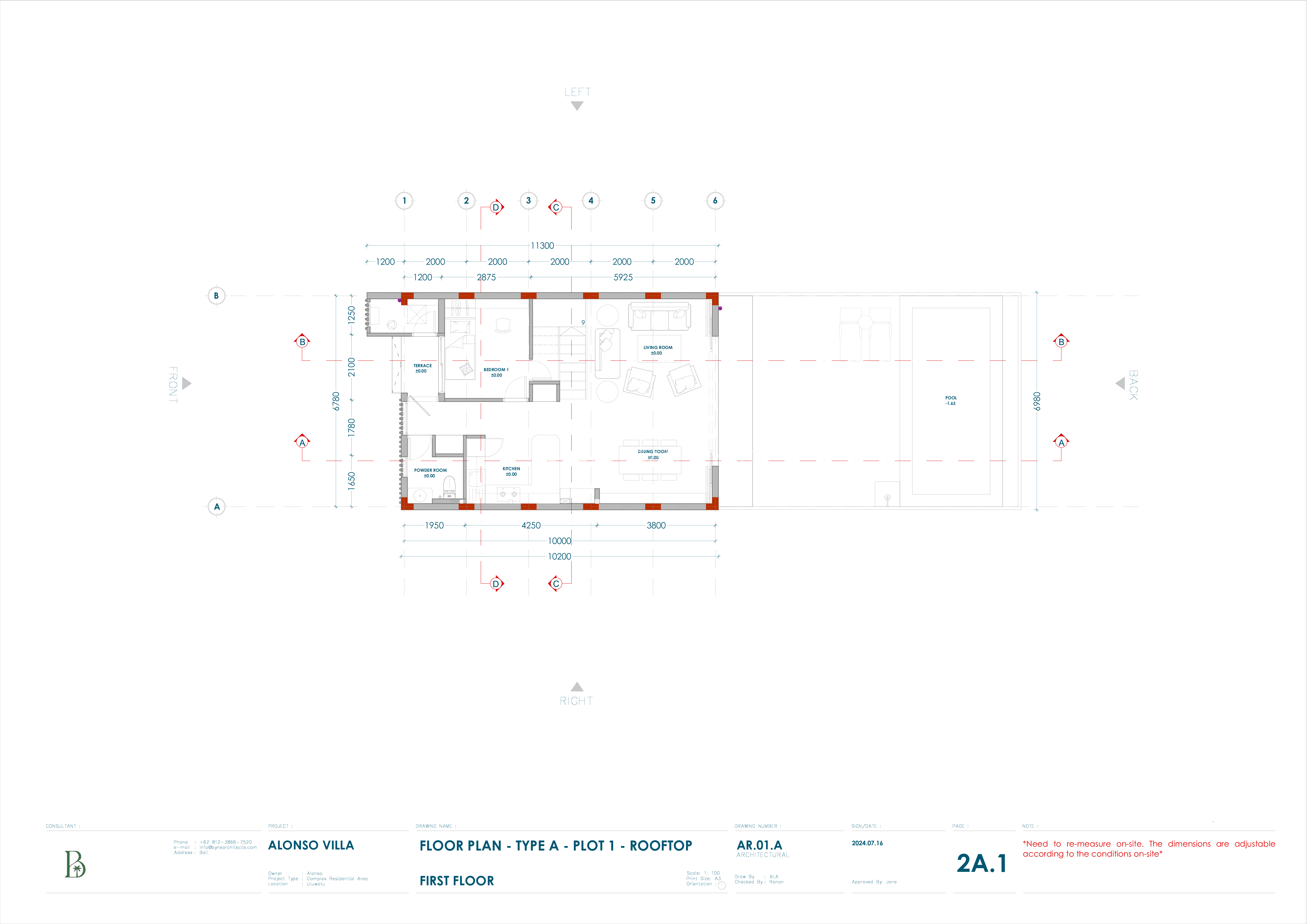

Discover an exquisite blend of Balinese tradition and modern luxury at this premium villa project in the heart of Uluwatu. Designed for discerning investors and lifestyle buyers, each villa offers a serene sanctuary with spacious interiors, a private pool, and lush gardens. Unique features like advanced thermal insulation and Bali’s largest residential water reservoir set a new standard in sustainable luxury. The project's layout emphasizes privacy and natural light, with optional rooftops offering spectacular views. Located in one of Bali's most sought-after coastal regions, you are minutes away from world-class surf breaks, cliff-top clubs, and spiritual retreats. This development promises not just a home, but a high-return investment asset crafted by renowned European and local architects, ensuring exceptional quality and future value appreciation.

Unit Configuration

Amenities

Legal and Financial Information

Ownership | Registeration Cost | Stamp Duty |

|---|---|---|

Leasehold | 1% of the sale value | 5% of the sale value |

Leasehold (27 Years + Extension Option) | Enquire to know more | Enquire to know more |

Leasehold (28 years with extension option) | Approx. 1% for Notary fees | 5% of the sale value (BPHTB) |

Leasehold (30 years + 20 years optional extension) | Approx. 1-2% for Notary and Legal Fees | 5% (BPHTB - Buyer-paid tax) |

Leasehold (29 years + 20 years extension) | Approx. 1-2% for notary and legal fees | 5% of the sale value (BPHTB) |

Leasehold | Approx. 1-2% for Notary and Legal Fees | 5% of the sale value (BPHTB) |

Leasehold (24 years + extension) | Enquire to know more | 5% of the sale value (BPHTB) |

Leasehold (24 years remaining) | Approx. 1-2% for notary and legal fees | 5% of the sale value (BPHTB) |

Leasehold (25 Years Remaining) | Approx. 1% of the sale value (Notary Fees) | 5% of the sale value (BPHTB) |

Leasehold (30 Years Remaining) | Approx. 1-2% for notary and legal fees | 5% of the sale value (BPHTB) |

Leasehold | Enquire to know more | 5% of the sale value (BPHTB) |

Leasehold (24 years + 30 years extension option) | As per local government norms | As per local government norms |

Freehold | 1-2% of the sale value for notary fees (indicative) | 5% of the sale value (indicative) |

Leasehold (30 years + 20 years extension) | 1% of the sale value | 5% of the sale value |

Leasehold (30 Years Remaining) | Approximately 1-2% of property value for notary fees. | 5% of the sale value (BPHTB) |

Freehold | 1-2% of the sale value | 5% of the sale value (BPHTB) |

Leasehold (29 years with a 30-year extension option) | Approx. 1% of the sale value (Notary Fees) | 5% of the sale value (BPHTB) |

Property Management

The project offers comprehensive post-possession property management services through a dedicated professional team. Services include rental marketing and management, housekeeping, landscaping, and routine maintenance. This turnkey solution makes it an ideal hassle-free investment for absentee owners, ensuring high rental yields and pristine upkeep of the property.

Financials Returns & Investment Benefits

• High capital appreciation potential in Bali's prime Uluwatu real estate market.

• Strong rental income prospects driven by high tourist footfall and luxury demand.

• Secure 30-year leasehold ownership with extension options, offering long-term value.

• A premium lifestyle asset in a world-renowned wellness and surfing destination.

Distance from Social Infrastructure

EDUCATIONAL INSTITUTIONS

• Green School Bali (Approx. 45 mins)

• Bali Island School (Approx. 40 mins)

MALLS

• Samasta Lifestyle Village (Approx. 20 mins)

• Sidewalk Jimbaran (Approx. 20 mins)

MARKET

• Uluwatu Local Market (Approx. 10 mins)

HOSPITALS

• BIMC Hospital Nusa Dua (Approx. 25 mins)

• Siloam Hospitals Bali (Approx. 35 mins)

Nunggalan

Uluwatu, perched on the dramatic cliffs of Bali's Bukit Peninsula, has transformed from a niche surf haven into a premier luxury real estate destination. The market is dominated by high-end villas and boutique resorts, attracting a global clientele of investors, entrepreneurs, and wellness enthusiasts. Property prices here are among the highest in Bali, driven by scarcity of prime cliff-front land and unabated demand for exclusive holiday homes. The lifestyle appeal is unmatched, offering a unique blend of spiritual tranquility, world-famous surf breaks, and sophisticated beach clubs, making it a hotspot for high-yield rental properties.

Road Connectivity

Jalan Raya Uluwatu Pecatu | 1 km | 2 mins

Airport

Ngurah Rai International Airport (DPS) | 18 km | 35-45 mins

Train Station

N/A

Bus Station

N/A

Climate Information

• Dry Season (Apr-Oct): 27-32°C - Sunny and less humid, perfect for outdoor exploration and beach life.

• Wet Season (Nov-Mar): 25-30°C - Higher humidity and tropical rain showers, resulting in vibrant green scenery.

• Shoulder Season (Apr, May, Sep): 26-31°C - Considered the best time to visit with excellent weather and fewer crowds.

Air Quality Index (approximate AQI as per online sources)

35 (Good)

About:

Bali

South Bali stands as the epicenter of Indonesia's tourism and real estate investment, encompassing key areas like Uluwatu, Seminyak, and Nusa Dua. The market's growth is fueled by robust international tourism, a large expatriate community, and continuous infrastructure development. Real estate demand spans luxury villas, branded residences, and commercial properties, offering diverse investment opportunities. Price ranges are broad, but the premium segment shows consistent appreciation. South Bali's strategic advantage lies in its proximity to the international airport and its concentration of world-class dining, entertainment, and wellness facilities.

Real Estate Trends in

Bali

Average price for luxury villas in Uluwatu is approximately ₹12,000 - ₹15,000 per sq.ft, with a year-on-year appreciation of 8-12%.

Short Term Rental Trends

Please find some relevant information below if you are looking to run your property as an airbnb on short term rentals. Please note that this data is an estimate collected from various online and offline resources by Avacasa. The actual performance is dependent upon your specific property, amenities, services, marketing etc. Use the below metrics as a general guide to the market to help in your decision making.

Occupancy Rate

*Occupancy rate represents the percentage of time a property is booked by guests compared to the total time it's available for rent. It's a key metric for understanding how well a market performs.

Average Daily Rate

*Average nightly rate earned for a 2bhk home

Gross Yield

75-85% annually

₹33,000

8-10% net rental yield per annum

*the annual rental income of a property expressed as a percentage of its purchase price, before any expenses like taxes or maintenance are deducted

Nearby Attractions

Few attractions and activities curated by us

Why Invest?

01

Prime Uluwatu location offers a blend of serene living and access to world-class surf spots.

02

Secure 30-year leasehold with a 20-year extension option ensures long-term asset value.

03

High demand for luxury villa rentals in Bali promises attractive rental yields and occupancy rates.

04

Own a wellness retreat with a private pool and garden in a globally recognized lifestyle destination.

Explore More